Case study: Cova's Unfulfilled Promise of All-in-One Wealth Management

Udokanma Georgewill

June 5, 2024

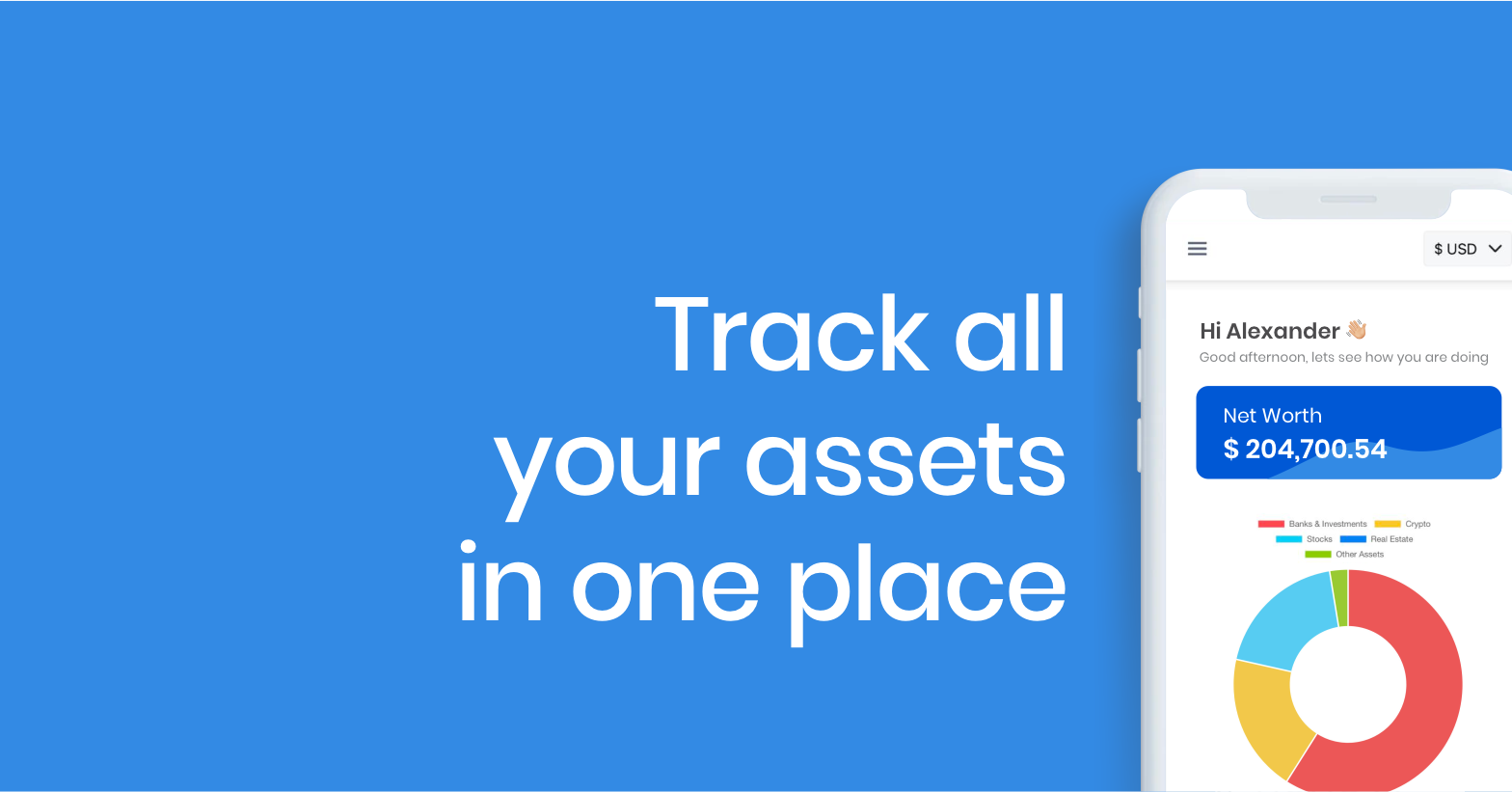

Cova was a Nigerian wealth-tech startup founded in December 2021 by Oluyomi Ojo and Yomi Osamiluyi to revolutionize personal finance management in Nigeria. With the ambitious goal of becoming a "single source of truth" for users' assets, Cova offered a user-friendly platform that aggregated information from various financial sources. Users could link their local and international bank accounts, savings apps, investment platforms, crypto-wallets, and even track their landed properties, providing a holistic view of their financial landscape.

The startup secured funding of at least $800,000 from investors, including prominent angel investor Olumide Soyombo. This initial success fueled optimism for Cova's potential to empower Nigerians by simplifying wealth management. The ability to track all investments and assets in one place, along with the promise of personalized financial insights, resonated with the vision of financially savvy Nigerians.

Cova's strategy hinged on financial aggregation. By integrating with various financial institutions, the platform aimed to provide a unified dashboard for users to understand their cash flow, net worth, and investment performance. This comprehensive overview could have empowered users to make informed financial decisions and potentially leverage Cova for personalized financial advice.

According to an email sent by Ojo to investors, documented in Olumide Soyombo's memoir (one of Nigeria's leading angel investors), the decision to shut down appears to be rooted in financial sustainability concerns (paraphrased from Ref: Pages 248 & 249).

Ojo highlights that, despite having some remaining funds, continuing operations wouldn't be prudent. He emphasizes the importance of acting in the best interests of investors and stakeholders, suggesting that Cova might not have had a clear path to profitability within a reasonable timeframe.

This sheds light on the potential challenges Cova faced, which we will uncover further;

Building User Confidence

Cova's core function relied on users connecting their various financial accounts, including bank accounts, investment platforms, and potentially even crypto-wallets. Building trust and ensuring robust security measures to protect this data would have been crucial for Cova's success.

The concept of aggregating sensitive financial data from various sources on one platform was unfamiliar to many users, leading to a barrage of questions and concerns. Cova had the crucial task of building trust by demonstrating robust security measures, transparent data handling practices, user authentication measures to mitigate these concerns, and a commitment to user privacy.

Educating potential users about the benefits and safeguards Cova offered would have been paramount in overcoming this initial hesitation.

Struggles with User Adoption

The $10 monthly subscription fee is a barrier to entry for a significant portion of the Nigerian population. While Nigeria has a growing middle class, a large percentage of the population still lives on low or moderate incomes. For these individuals, a $10 monthly fee for a wealth management platform might be considered a luxury expense.

Furthermore, even for Nigerians interested in wealth management, Cova's subscription fee might be seen as excessive compared to other financial products or services they utilize. Cova may have struggled to attract a large enough user base to support its operations if it was perceived as catering only to a niche market of high-net-worth individuals.

Balancing Value and Affordability

Even with a large user base, the value proposition of a $10 monthly subscription could be a tough sell. This price point might have limited Cova's appeal to a wider audience in Nigeria, particularly those with moderate or lower incomes. Targeting a niche market of high-net-worth individuals could restrict growth and make it difficult to achieve the number of subscribers needed to sustain the business. Relying solely on a single subscription fee creates a fragile revenue model. If users perceive the value proposition as not strong enough to justify the cost, churn (cancellation of subscriptions) could become a significant problem.

Failing to Adapt to Changing Needs

In response to some of the startup's challenges in its first year, Ojo noted that users desired seamless connections for their multiple bank accounts across different countries. This highlights the growing sophistication of Cova's target audience. Users were not satisfied with basic functionalities; they craved a more comprehensive platform that could handle the complexities of their global financial lives. Cova, in its early stages, might not have been fully equipped to handle these intricate integration requests, requiring them to adapt and enhance their platform's capabilities.

This serves as a reminder of the fintech industry's constant competition and demands, especially for startups. We hope that these stories provide valuable insights for future fintech ventures in Africa, helping them navigate this complex ecosystem and develop sustainable business models.