2024 Startup Graveyard Report

An in-depth analysis of the startups that failed in the last year and what we can learn from them.

Introduction

Overview of Africa's Startup Ecosystem

The first startup, Interswitch, was launched in Africa in 2002. The company has made a name for itself focused on providing financial inclusion and easy digital payments. Its popular payment processing solutions include Verve and Quickteller. Mocality, a Kenyan startup, shut down in 2013. It was an online directory service that ceased operations due to fierce competition and issues with sustainability.

While Mocality is said to have been one of Africa's earliest startup shutdowns, no comprehensive directory contains data that provides factual information about this occurrence. Admittedly, the ecosystem is evolving rapidly due to economic factors, market volatility, and unfavourable regulatory policies. However, this does not excuse the need for extensive documentation, as its effects are far-reaching.

Startup Graveyard Africa was born out of the need to solve this problem. By documenting startup shutdowns and the reasons for their failures, we hope to de-stigmatize failure and provide valuable insights for other entrepreneurs, business investors, and startup enthusiasts.

The 2024 Startup Graveyard Report is the first of its kind. It promises more to come, providing extensive data about Africa's startup ecosystem and case studies about shutdowns and their causes. We hope this report will be a valuable resource for entrepreneurs and investors.

Purpose of the Report

This report aims to analyze the reasons behind startup failures in 2024, compare them with the challenges faced in 2023, and extract valuable lessons that can help future entrepreneurs avoid similar pitfalls.

Methodology

Data Collection

Data was gathered from our case studies and relevant blog articles (startupgraveyard.africa/blog) as well as multiple sources including news articles, industry blogs, company reports, and social media posts. The data was then verified by cross-referencing with other sources to ensure accuracy.

Selection Criteria

Startups were selected based on the impact of their failure, the funding they received, and their significance in their respective industries.

Why Startups Failed

Common Themes

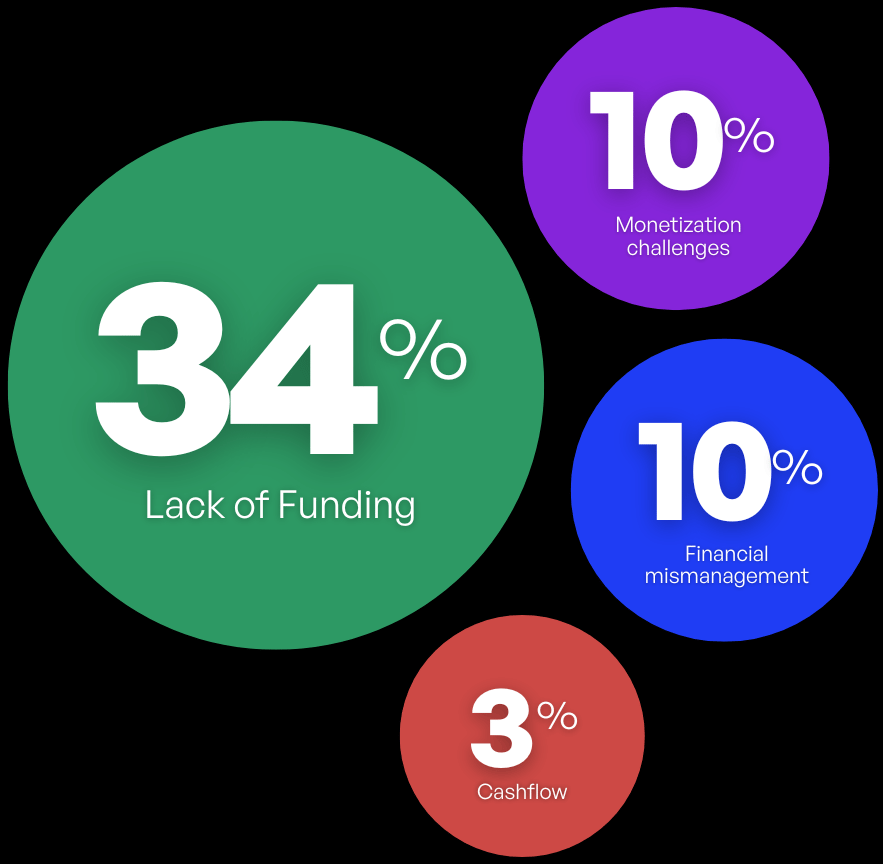

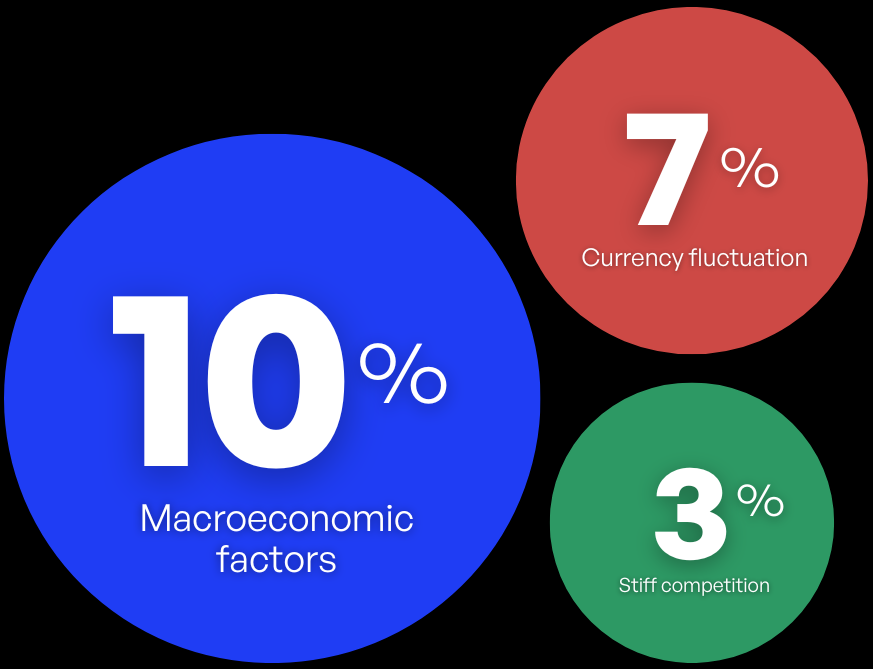

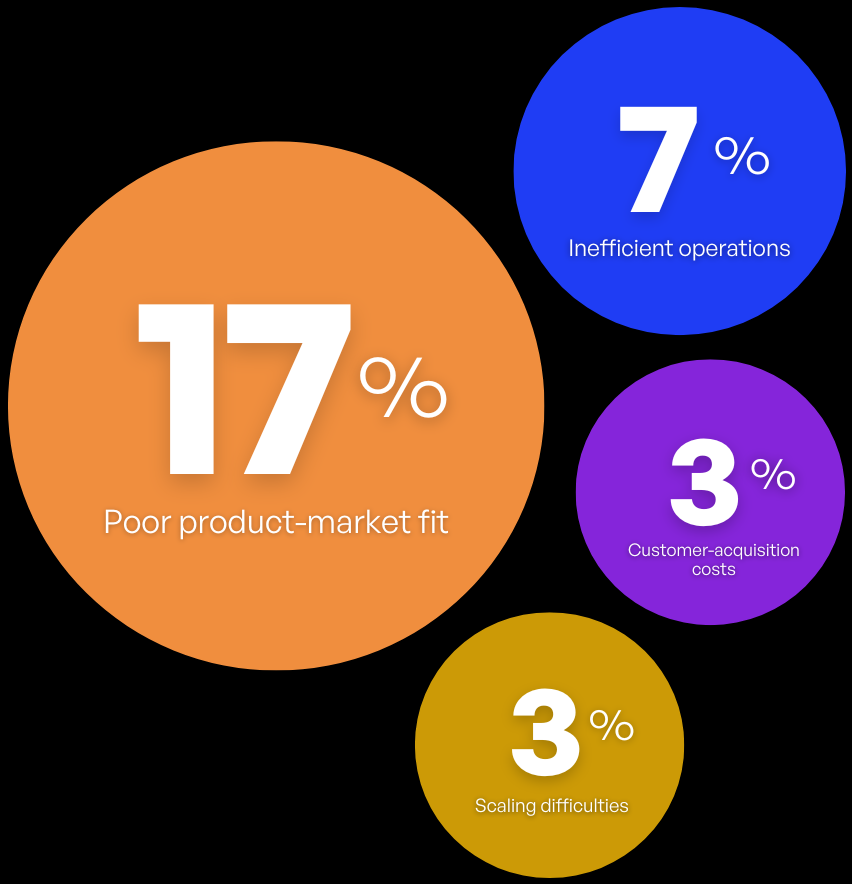

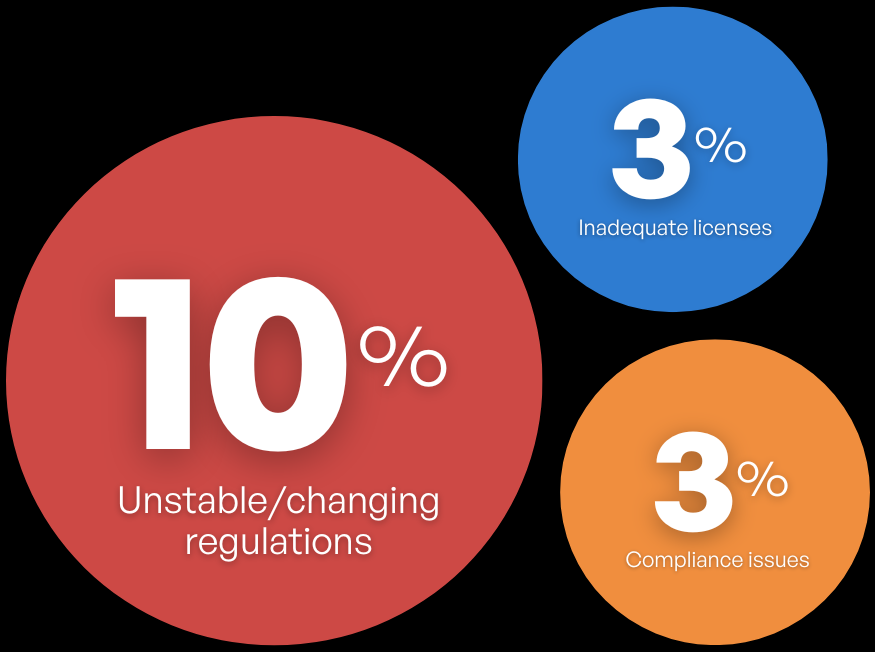

Across the startups that failed, several common themes emerged: financial difficulties (58%), market-related factors (20%), regulatory issues (17%), and operational challenges (27%).

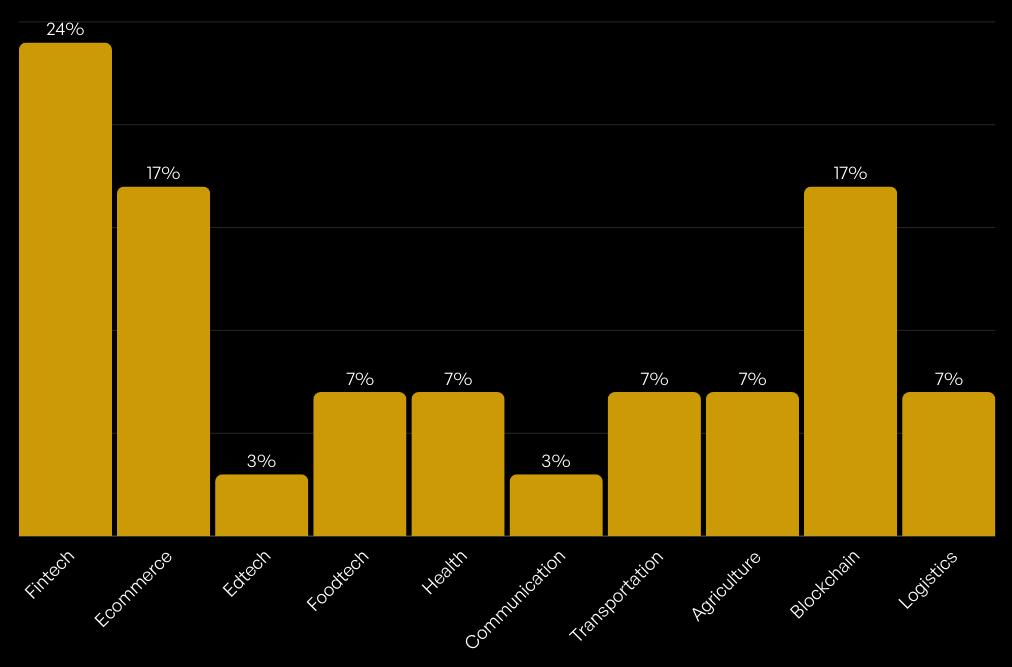

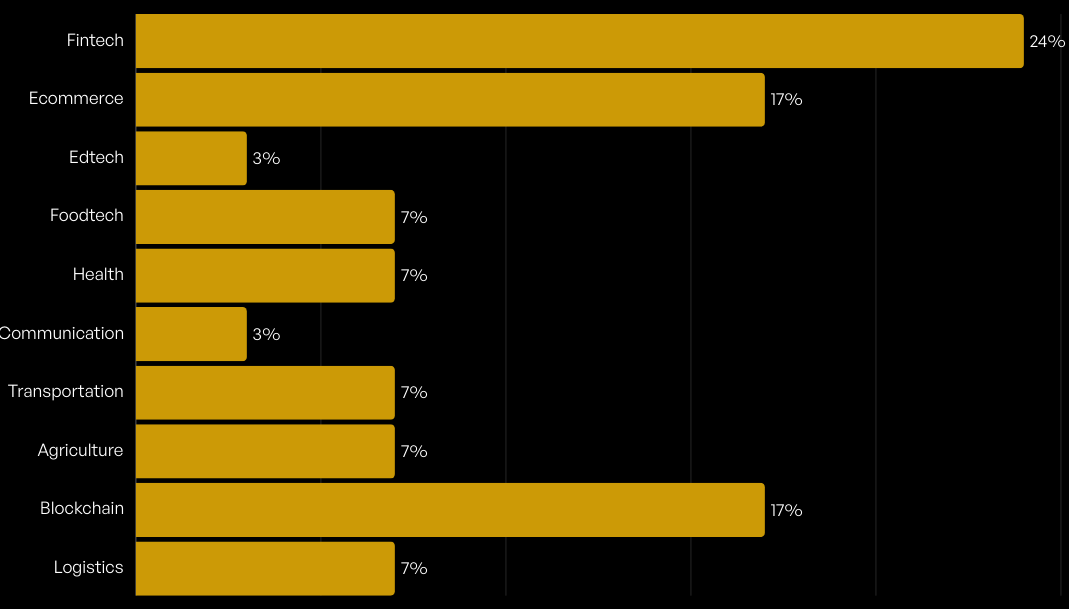

Startup Categories

The startups that shutdown were categorized into various sectors, including fintech, healthcare, blockchain, and education. The majority of startups were in the fintech sector, accounting for 24% of the total. The second-largest sector was e-commerce, with 17% of the total. The remaining sectors were distributed as follows:

What 2024 Taught Us

- Best Practices

- Some startups overcame challenges by being flexible and constantly iterating on their product. These businesses showed that adaptability and innovation are key to overcoming hurdles.

- Risk Mitigation

- Startups can reduce risks by diversifying their revenue streams, forming strategic partnerships, and fostering a culture of innovation. These strategies help minimize the impact of market fluctuations.

- Building Resilient Startups

- Startups that focus on building a solid foundation, from strong leadership to adaptable business models, are better equipped to withstand economic downturns and unforeseen challenges.

Conclusion

Future Outlook

While challenges persist, the future for African startups remains promising. Entrepreneurs can overcome obstacles by learning from past mistakes and focusing on long-term growth.

Policy Recommendations

Governments can support startups by providing better access to funding, offering tax incentives, and creating policies that foster innovation. These actions would help create a more conducive environment for entrepreneurship

Summary of Key Findings

The main factors behind startup failures in 2024 include financial mismanagement, market-related issues, operational challenges, and weak leadership. These lessons highlight the importance of strategic planning and flexibility.

Subscribe to our newsletter

Stay in the Loop

Subscribe to get updates straight to your inbox and stay inspired on your entrepreneurial

journey.

We respect your privacy. No spam, just valuable content