Case study: Inside the Fall of Dash

Udokanma Georgewill

August 24, 2024

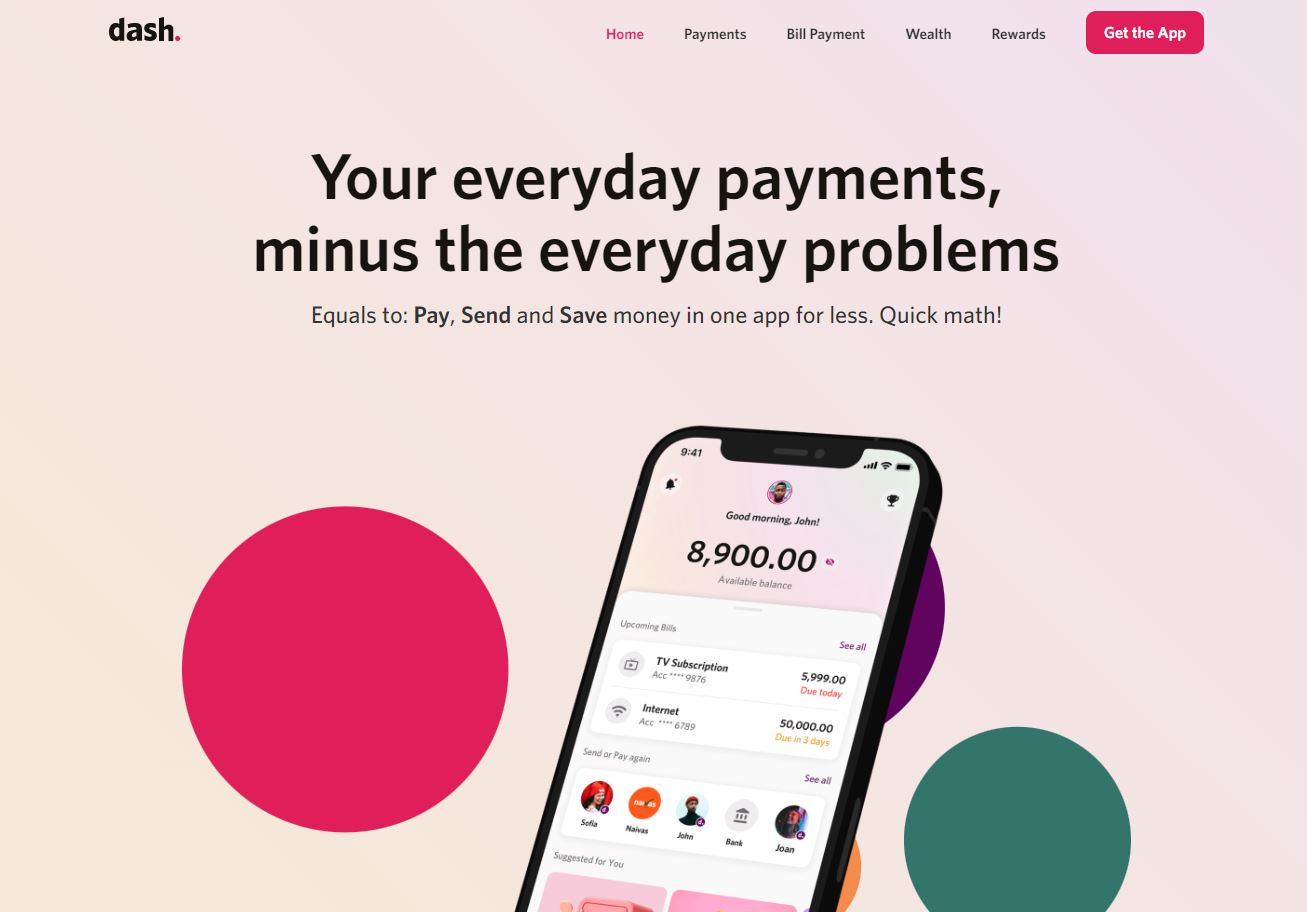

Ghana has been on a roll, creating an environment conducive to tech startup growth. With innovative solutions emerging across sectors, from fintech to agri-tech, Ghanaian entrepreneurs leverage technology to address local challenges and create scalable businesses. One of these innovations was Dash, a fintech startup with an audacious ambition to bridge the gap between mobile money wallets and bank accounts, promising seamless financial transactions across the continent.

Prince Boakye Boampong founded Dash in 2019, which quickly garnered attention with its innovative approach. The startup recognized a critical pain point for millions of Africans, the difficulty and expense of sending money across borders. Traditional methods were usually slow, costly, and unreliable. Dash aimed to disrupt this landscape by providing a swift, affordable, and convenient platform. This would enable users to send and receive money effortlessly, regardless of location or financial institution. Dash built a robust technology infrastructure capable of handling high transaction volumes and ensuring security to facilitate this.

Big Money, Big Dreams

Dash quickly became a popular choice for sending money because it was much faster, more convenient, and less expensive than traditional methods. The company was also smart about how it told people about its service. They used clever advertising and teamed up with big phone companies to reach a wide audience. Because of these efforts, Dash was able to get many people to sign up and use their service in a very short time.

In 2021, Dash reached a major milestone when it received a huge investment of $32.8 million. This was a record-breaking amount of money for a new African company and showed investors had a lot of faith in Dash's potential. With this extra money, Dash expanded its operations beyond its original market. They moved into Nigeria and Kenya, two of the biggest countries in Africa, to reach even more people and process even more money.

Overall, the company secured over $85 million in funding within five years from major investors and was valued at over $200 million, making it one of Africa's most valuable fintech startups. Dash also reported $1 billion in processed transactions and claimed five million users from Ghana, Nigeria, and Kenya.

The Roadblocks to Dash’s Success

Dash started to show signs of trouble. In early 2022, a major setback occurred when the Bank of Ghana stopped their operations. It didn't have the right papers to run its business in Ghana. This was a serious mistake because Ghana was an important place for the company. As a result, the government had to stop Dash from operating for a while. This setback made people doubt and stop trusting the company.

The controversies didn't end there, there were rumors that Dash didn't handle money well. People said the company wasn't honest or responsible with people's money. These were bad things to be accused of because Dash was supposed to be all about being open and clear about everything. When people heard these things, they stopped believing in Dash and stopped using the app. The CEO was removed from their position due to accusations of mishandling the company's money. Kenneth Kinyua, former CEO of Kopo Kopo, assumed the role of interim CEO. Although the audit findings were kept confidential, rumors suggested it revealed complex fabrications meant to deceive investors.

The Impact and Lessons from Dash Closure

New businesses need to have big ideas and be creative, but they also need to follow the rules and be careful with money. Dash showed us that even with a great idea, it's possible to fail if you don't do these things right. Even though Dash failed, it has taught how easy it could be for everyone to use money, not just rich people. But it also showed us that we need clear rules to ensure these new “money apps” work safely and fairly for everyone.

Essentially, the Ghanaian government and financial regulators should also implement measures to prevent similar occurrences. This includes establishing clear licensing requirements, conducting thorough due diligence on fintech startups, and setting up flexible yet strict compliance standards.